|

A |

case for syndicated estafa has been recommended for filing against eleven (11) directors and officers of Pacific Plans, Inc. (PPI) and/or Lifetime Plans, Inc. (LPI).

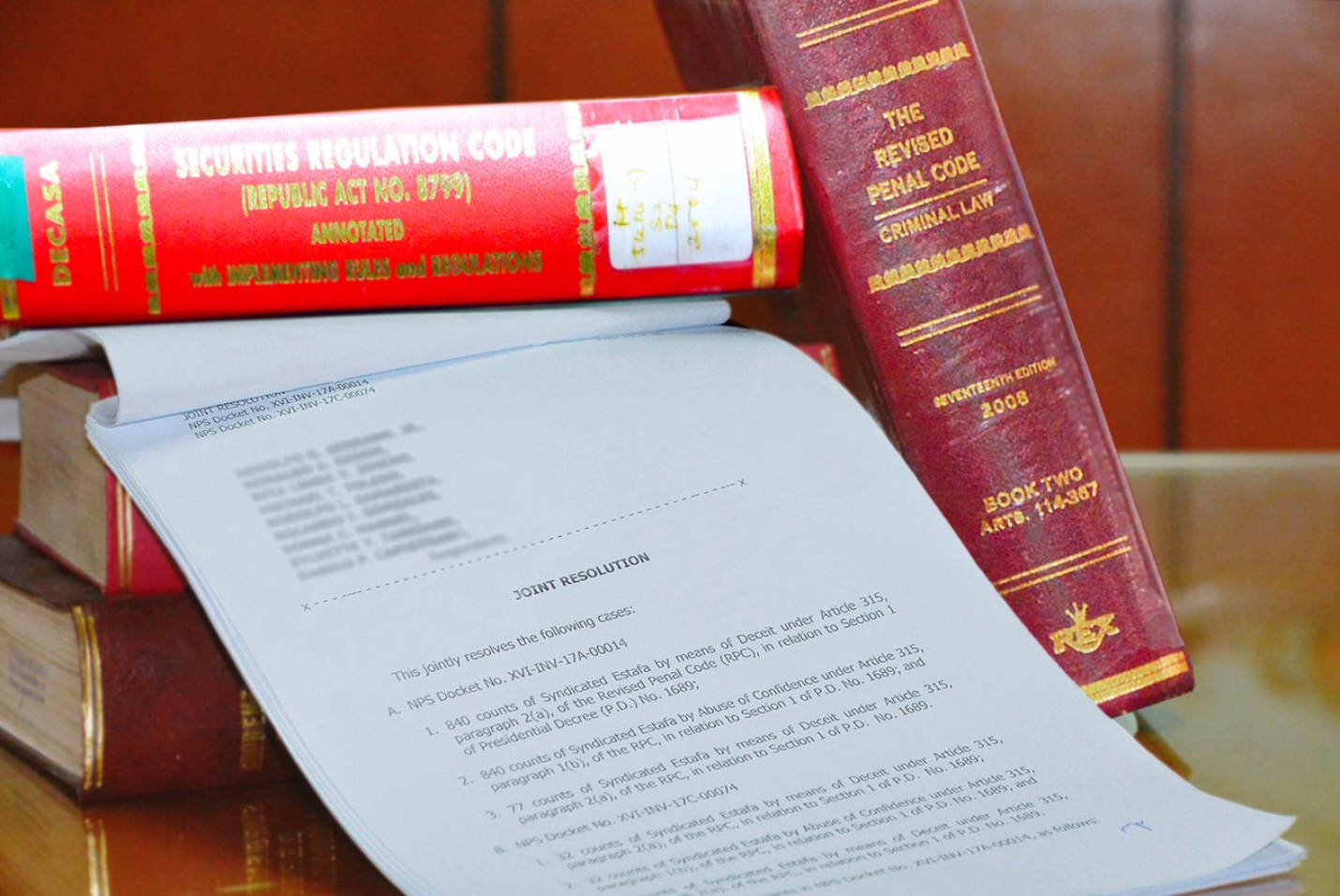

In a recently-released Joint-Resolution dated 7 August 2018, Assistant State Prosecutor (ASP) Mary Ann S. Parong found the PPI and/or LPI directors and officers to have caused or authorized the issuance or sale of pre-need plans to the public despite the fact that their company lacked a secondary license from the Securities and Exchange Commission (SEC). A pre-need plan issuer such as PPI and LPI is required by the Securities Regulation Code to obtain such secondary license which authorizes it to engage in the pre-need industry.

|

Syndicated Estafa

Estafa is committed when fraud is employed to the prejudice of another person. It may be committed in several ways, such as (a) through unfaithfulness or abuse of confidence; (b) by false pretense or fraudulent acts executed prior to or simultaneous with the commission of the fraud; (c) by other fraudulent means; or (d) by swindling or other deceits.

Depending on how it is committed, penalty for estafa may be, among others, minimum of aresto menor (imprisonment from one to thirty days) to a maximum of reclusion temporal (imprisonment from 12 years and one day to twenty years). However, when estafa is syndicated, the penalty become life imprisonment to death.

Estafa is syndicated when five or more persons group together with the intention of carrying out the unlawful or illegal act, transaction, enterprise or scheme, and the defraudation results in the misappropriation of money contributed by stockholders, or members of rural banks, cooperative, "samahang nayon(s)," or farmers association, or of funds solicited by corporations/associations from the general public.

|

Pre-need plans and corporate spin-offs

Complainants numbering four hundred seventy-three (473) filed complaints in which they accused PPI and LPI directors and officers of fraud. They alleged having purchased PPI and LPI pre-need plans from 2004 to 2008.

However, in April of 2005, PPI petitioned for corporate rehabilitation due to financial woes. Generally, during corporate rehabilitation, claims of creditors - plan holders included - are suspended. This is a form of a respite which allows a company under rehabilitation to recover from it financial woes.

Complainants however alleged that PPI made assurances that rehabilitation proceedings will not cover pre-need plans. However, in August 2014, PPI moved to include the pre-need plans in the rehabilitation proceedings.

Complainants likewise learned that sometime in 2004, PPI transferred the management of their pre-need plans to LPI, then to two other corporations. They alleged that these "spin-off schemes" prejudiced them because, among others, the plans were sold at a losing price, and because management and other fees were incurred as a result of such transfers. Also in 2005, PPI was sold to another company.

Complainants alleged that the inclusion of the plans in the rehabilitation proceedings, their transfers, and the sale of the company itself, constitute fraud.

School fees deregulation and the financial crisis

In its defense, PPI traced its financial woes to the deregulation of the tuition and other fees of private schools which pushed up the cost of education and put financial pressure on traditional educational plans and their trust funds. It likewise pointed to the deteriorating business environment arising from the late 1990s financial crisis. Because of these, PPI had to spin-off and reorganize its business and segregate the pension and memorial plan and education plan businesses. It however noted that this spin-off was approved by the SEC and was not made in bad faith.

PPI and LPI likewise argued that the transfer of the pre-need plans to the spun-off companies was not done in fraud of plan holders. Likewise, they clarified that their application for corporate rehabilitation and the subsequent inclusion of the pre-need plans in said proceedings, was intended to provide the company respite from financial distress and provide them time to recover.

Fraud in the sale of plans without license

In her Joint Resolution, ASP Parong found no fraud in the transfer of plans and corporate spin-offs of PPI and LPI. However, she found that the PPI and LPI directors and officers defrauded the public because they falsely pretended to possess the requisite secondary license to issue pre-need plans when in fact it did not.

ASP Parong stressed that the LPI's own Certificate of Incorporation expressly required it to obtain a secondary license from the SEC. That it did not constitute a violation of the law. "It is evident that... the above-named... directors/officers of (LPI) caused the issuance of pre-need plans without the requisite license... By doing so, (they)... falsely pretended to possess qualifications in the issuance of said pre-need plans when in fact they were not authorized to issue the same" the Joint Resolution in part read.

ASP Parong likewise held liable certain PPI directors and officers because "they paved the way for the birth of LPI." She pointed to LPI's Articles of Incorporation which show that PPI as its major subscriber.

An information against the 11 will now be filed in court. Syndicated estafa carries a penalty of life imprisonment to death.